2022 Year-End Shareholder Letter

2022 Year-End Shareholder Letter

February 10, 2023

Dear Investor,

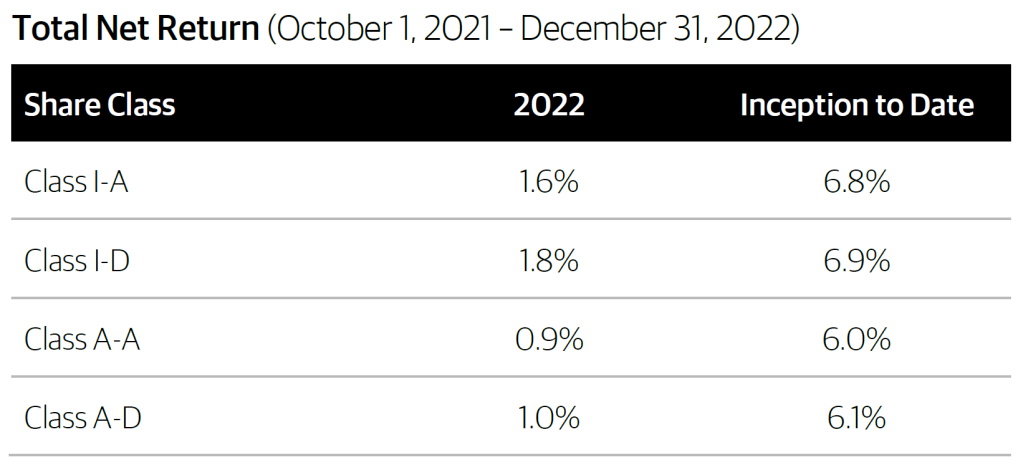

We are proud of what we have achieved since launching BEPIF in 2021, and have delivered on our goal of providing individual investors access to high-quality, private European real estate. BEPIF delivered positive performance, returning 1.6% net of fees and expenses over the course of 2022, and 6.8% since inception, meaningfully outperforming European public REITs, global equities and global fixed income.1

We believe our high conviction, thematic portfolio is well-positioned in the current environment. BEPIF’s “70/80/90” portfolio is designed to benefit from long-term, secular growth tailwinds, and our balance sheet provides the flexibility to be both offensive and defensive as the investment environment evolves. BEPIF is ~70% concentrated in premier logistics assets across major European distribution hubs.2 Logistics is Blackstone Real Estate’s highest conviction investment theme globally as e-commerce growth and supply chain re-alignment continue to drive strong demand for logistics assets, while limited new supply and record low vacancy have resulted in meaningful rent increases as leases mark-to-market.3,4 Continental European e-commerce penetration lags the U.S. by ~40%, indicating significant room for continued growth potential in the sector.5 The balance of the portfolio is invested in newly-built, high-quality office properties (25%) with strong ESG credentials located in growth markets, and a prime data center in London (8%) where surging growth in data creation and storage is driving demand.6

Additionally, in the wake of historically strong rent growth, market rents are 14% above BEPIF’s in-place rents, creating embedded upside potential which should position BEPIF for continued cash flow growth even if market rent growth moderates.7 With ~80% of BEPIF’s portfolio rents linked to rates of inflation or regular rent reviews, and a focus on leases with low exposure to input costs, we remain confident in BEPIF’s ability to benefit from rising inflation.8 Finally, as the investment environment continued to evolve, we proactively managed BEPIF’s balance sheet, significantly increasing our fixed-rate and hedged liabilities to ~90% by year end, mitigating the impact of rising interest rates, and generating significant balance sheet gains.9

Despite BEPIF’s strong sector selection and prudent balance sheet management, we acknowledge the challenges over the course of 2022: a rapidly changing interest rate environment, a European energy crisis, and an ongoing war in Ukraine all created uncertainty that weighed on investor sentiment. We believe we were responsive to this evolving backdrop and reflected these shifts in our monthly valuation process and NAV. Since April 2022, BEPIF has increased exit cap rates (lowered valuation multiples) by 8% and discount rates by 4%.10 BEPIF’s semi-liquid structure reflects that private real estate is meant to be held medium to long-term, and is designed to prevent a liquidity mismatch, protecting shareholder value, particularly during periods of dislocation.

We are excited for what lies ahead for BEPIF as it continues to grow. Blackstone Real Estate has a 25-year track record of successfully navigating market cycles in Europe, and we believe the current dislocation will create a rich environment for us to capitalize on attractive investment opportunities as they arise. Our proven European team of over 200 professionals enables us to have real-time local insights in a more fragmented and opaque European market, while benefitting from the collective strength of our global platform.

As we start the new year, we remain focused on delivering strong long-term performance and believe BEPIF is well-positioned to offer individual investors the potential for a hedge to inflation, asset appreciation, and consistent dividends.

Thank you for your continued confidence – we are grateful for the responsibility you have entrusted with us.

Sincerely,

Performance Highlights

6.8%

Inception to Date Net Return for Class I-A

1.6%

2022 Net Return for Class I-A

€2.9B

Gross Asset Value

Frank Cohen

Global Chairman of Core+ Real Estate

Wesley LePatner

Global Head of Core+ Real Estate & BEPIF Director

James Seppala

Head of Real Estate Europe & BEPIF Chairman

Abhishek Agarwal

Head of Core+ Real Estate Europe & BEPIF Director

Your capital is at risk and you may lose some or all of your investment. Past performance is not necessarily indicative of future results. There can be no assurance that BEPIF will achieve its objectives or avoid substantial losses. Real estate income may not be correlated to or continue to keep pace with inflation. BEPIF is not managed in reference to any benchmark index. The index does not represent a benchmark for BEPIF’s performance, but rather is disclosed to allow for comparison of BEPIF’s performance to that of a well-known and widely recognized index. Returns may increase or decrease as a result of currency fluctuations. The above are examples of select investment themes that Blackstone currently pursues and are subject to change. There can be no assurance that any of the trends described herein will continue in the future or will not reverse. ESG initiatives may not apply to some or all of BEPIF’s investments and none are binding aspects of the management of the assets of BEPIF. There can be no assurance that ESG initiatives will continue or be successful. Different investor eligibility requirements and minimum subscription amounts may apply in certain jurisdictions. Please refer to the Prospectus for further information.

2022 YEAR IN REVIEW

2022 Investment Highlights

Mileway – Pan-European

Adare Office Asset – Dublin, Ireland

Luna Logistics Portfolio – Italy

Real Estate Portfolio Snapshot

As of December 31, 2022, unless otherwise indicated. Represents Blackstone’s view of the current market environment as of the date appearing in this material. When used in this document and unless otherwise specified or unless the context otherwise requires, references to the “Fund” should be read as references to Blackstone European Property Income Fund SICAV (“BEPIF”), Blackstone European Property Income Fund (Master) FCP and their parallel entities. All metrics presented in this materials relate to the Fund, except performance, which relates to BEPIF. The inception date for Class I-A, Class I-D, Class A-A and Class A-D shares is October 1, 2021. Please refer to the Prospectus for further information. See “Important Disclosure Information”, including “Sources, Third Party Information and Blackstone Proprietary Data”, “Embedded Growth”, “Operating Metrics”, “Estimates / Targets” and “Trends”.

Your capital is at risk and you may lose some or all of your investment. The figures herein include preliminary, unaudited results, which are subject to further review and adjustment. Past performance is not necessarily indicative of future results. There can be no assurance that the Fund will achieve its objectives or avoid substantial losses. Currency fluctuations may have an adverse effect on the value, price, income or costs of the product, which may increase or decrease as a result of changes in exchange rates.

Summary of Key Risk Factors

Under the packaged retail and insurance-based investment products (PRIIPs) Regulation, we have classified this product as 4 out of 7, which is a medium risk class. This rates the potential losses from future performance at a medium level, and poor market conditions could impact our capacity to pay you. There is no specific recommended holding period for the product. The actual risk can vary significantly. You may not be able to sell your product easily or you may have to sell at a price that significantly impacts how much you get back. The summary risk indicator is a guide to the level of risk of this product compared to other products. It shows how likely it is that the product will lose money because of movements in the markets or because we are not able to pay you.

The attention of potential investors is drawn to the risks to which any investor is exposed by investing in BEPIF. Potential investors should pay particular attention to the risks described in the dedicated section of the Prospectus and Key Information Document (KID). In making an investment decision, investors must rely on their own examination of BEPIF and the terms of the offering, including the merits and risks involved. Potential investors should not construe the contents of this website and/or the Prospectus as legal, tax, investment or accounting advice.

The following is a summary description of the principal risks of investing in BEPIF. The order of the below risk factors does not indicate the significance of any particular risk factor. Complete information on the risks of investing in BEPIF is set out in the Prospectus.

Risk of Capital Loss and No Assurance of Investment Return. BEPIF offers no capital protection guarantee. This investment involves a significant risk of capital loss and should only be made if an investor can afford the loss of its entire investment. There are no guarantees or assurances regarding the achievement of investment objectives or performance. This product does not include any protection from future market performance so you could lose some or all of your investment. If we are not able to pay you what is owed, you could lose some or all of your investment. A fund’s performance may be volatile. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment. A fund’s fees and expenses may offset or exceed its profits. In considering any investment performance information contained in this website and the documents linked to it (“the Materials”), recipients should bear in mind that past performance does not predict future returns.

Lack of Liquidity. There is no current public trading market for the shares, and Blackstone does not expect that such a market will ever develop. Therefore, redemption of shares by BEPIF will likely be the only way for you to dispose of your shares. BEPIF expects to redeem shares at a price equal to the applicable net asset value as of the redemption date and not based on the price at which you initially purchased your shares. Shares redeemed within one year of the date of issuance will be redeemed at 95% of the applicable net asset value as of the redemption date, unless such deduction is waived by BEPIF in its discretion, including without limitation in case of redemptions resulting from death, qualifying disability or divorce. As a result, you may receive less than the price you paid for your shares when you sell them to BEPIF pursuant to BEPIF’s redemption program.

The vast majority of BEPIF’s assets are expected to consist of real estate properties and other investments that cannot generally be readily liquidated without impacting BEPIF’s ability to realize full value upon their disposition. In addition, total redemptions across the Fund are generally limited to 2% of aggregate NAV per month and 5% per calendar quarter. Therefore, BEPIF may not always have a sufficient amount of cash to immediately satisfy redemption requests. As a result, your ability to have your shares redeemed by BEPIF may be limited and at times you may not be able to liquidate your investment.

Concentration. The Fund’s investment strategy is substantially concentrated in the real estate sector and its performance will therefore be closely tied to the performance of this sector which has historically experienced substantial price volatility. The Fund’s concentration in the real estate sector may present more risks than if it were broadly diversified over numerous industries and sectors of the economy.

Conflicts of Interest. There may be occasions when the fund manager and its affiliates will encounter potential conflicts of interest in connection with BEPIF’s activities including, without limitation, the allocation of investment opportunities, relationships with Blackstone’s and its affiliates’ investment banking and advisory clients, and the diverse interests of BEPIF’s investors.

Exchange Currency Risk. BEPIF is denominated in Euro (EUR). Shareholders holding shares with a functional currency other than Euro acknowledge that they are exposed to fluctuations of the Euro foreign exchange rate and/or hedging costs, which may lead to variations on the amount to be distributed. This risk is not considered in the indicator shown above. Fund charges will be incurred in multiple currencies, meaning that payments may increase or decrease as a result of currency exchange fluctuations.

Highly Competitive Market for Investment Opportunities. The activity of identifying, completing and realizing attractive investments is highly competitive, and involves a high degree of uncertainty. There can be no assurance that the Fund will be able to locate, consummate and exit investments that satisfy its objectives or realize upon their values or that the Fund will be able to fully invest its available capital. There is no guarantee that investment opportunities will be allocated to the Fund and/or that the activities of Blackstone’s other funds will not adversely affect the interests of the Fund.

Real Estate Investments. The Fund’s investments do and will consist primarily of real estate investments and real estate-related investments. All real estate investments are subject to some degree of risk. For example, real estate investments are relatively illiquid and, therefore, will tend to limit Blackstone’s ability to vary the Fund’s portfolio promptly in response to changes in economic or other conditions. No assurances can be given that the fair market value of any real estate investments held by the Fund will not decrease in the future or that the Fund will recognize full value for any investment that the Fund is required to sell for liquidity reasons. Deterioration of real estate fundamentals generally may negatively impact the performance of the Fund. In addition, the Fund may be subject to more specific risks relating to inter alia the residential, commercial or the industrial real estate sectors.

Recent Market Events Risk. Local, regional, or global events such as war (e.g., Russia/Ukraine), acts of terrorism, public health issues like pandemics or epidemics (e.g., COVID-19), recession, or other economic, political and global macro factors and events could lead to a substantial economic downturn or recession in the U.S. and global economies and have a significant impact on the Fund and its investments. The recovery from such downturns is uncertain and may last for an extended period of time or result in significant volatility, and many of the risks discussed herein associated with an investment in the Fund may be increased.

Reliance on Key Management Personnel. The success of the Fund will depend, in large part, upon the skill and expertise of certain Blackstone professionals. In the event of the death, disability or departure of any key Blackstone professionals, the business and the performance of the Fund may be therefore adversely affected. Some Blackstone professionals may have other responsibilities, including senior management responsibilities, throughout Blackstone and, therefore, conflicts are expected to arise in the allocation of such personnel’s time (including as a result of such personnel deriving financial benefit from these other activities, including fees and performance-based compensation).

Sustainability Risks. BEPIF may be exposed to an environmental, social or governance event or condition that, if it occurs, could have a material adverse effect, actual or potential, on the value of the investments made by BEPIF. Sustainability risks are assessed into investment decisions relating to BEPIF.

Target Allocations. There can be no assurance that the Fund will achieve its objectives or avoid substantial losses. Allocation strategies and targets depend on a variety of factors, including prevailing market conditions and investment availability. There is no guarantee that such strategies and targets will be achieved and any particular investment may not meet the target criteria.

Use of Leverage. The Fund may borrow money. If returns on such investment exceed the costs of borrowing, investor returns will be enhanced. However, if returns do not exceed the costs of borrowing, Fund performance will be depressed. This includes the potential for the Fund to suffer greater losses than it otherwise would have. The effect of leverage is that any losses will be magnified. The use of leverage also exposes the Fund to the risk of an increase in interest rates.

Variable Valuations. The valuation of Fund’s investments will be difficult, may be based on imperfect information and is subject to inherent uncertainties, and the resulting values may differ from values that would have been determined has a ready market existed for such investments, from values placed on such investments by other investors and from prices at which such investments may ultimately be sold.

Opinions expressed reflect Blackstone’s view of the current market environment as of the date appearing in the relevant sections of this website only.

- BEPIF Class I-A net return. Global equities represented by the MSCI ACWI GR EUR Index, a stock index designed to provide a broad measure of global equity market performance. European public REITs represented by the FTSE EPRA Nareit Developed Europe TR EUR Index, a subset of the FTSE EPRA Nareit Developed Index and is designed to track the performance of listed real estate companies and REITS in Europe. Global fixed income represented by the Bloomberg Global Aggregate TR EUR Index, a Euro-denominated index and includes fixed-rate, investment-grade bonds. The principal sectors in the index are the Treasury, corporate, government-related and securitised. All indices refer to the Total Return, measured by the actual return on an investment over a given period, and are EUR-denominated and expressed in EUR. Total Returns indices refer to regular cash dividends reinvested at the close on the ex-dividend date.

- Sector breakdown by GAV at Fund share including underlying investments within Blackstone’s open ended European Core+ fund for institutional investors, excluding debt investments.

- CBRE, as of September 30, 2022. Demand and supply represents total take-up and completion in France, Germany, Italy, the Netherlands, Spain and the U.K. between Q1 2012 and Q3 2022. Vacancy is weighted by logistics exposure in Blackstone’s open-ended European Core+ funds (based on sqm owned).

- Blackstone proprietary data.

- As of September 30, 2022. Continental Europe: GlobalData. Continental Europe represents the weighted average of e-commerce penetration based on retail sales for Germany, the Netherlands, France, Spain and Italy. U.S.: U.S. Census Bureau represents sales share of total retail sales excluding auto, gas and food services. E-commerce penetration reflects a trailing 12-month period.

- IDC, as of December 31, 2021.

- Blackstone proprietary data. Any expectations that in-place rents have the potential to increase are based on certain assumptions that may change and do not constitute forecasts. Such growth potential is hypothetical, provided for informational purposes only, and does not represent the actual or estimated future performance of BEPIF.

- As of September 30, 2022. Represents direct real estate investments and Blackstone’s open-ended European Core+ fund for institutional investors.

- Represents direct real estate investments and Blackstone’s open-ended European Core+ fund for institutional investors. Fixed-rate or hedged liabilities includes debt that has been swapped from floating to fixed-rate (inclusive of forward starting swaps), interest rate caps and matched debt.

- Weighted average GAV at Fund share. On a same store portfolio and includes all assets acquired prior to May 2022 which represents ~80% GAV at share.

- Sector and geographic breakdown by GAV at Fund share including underlying investments within Blackstone’s open-ended European Core+ fund for institutional investors, excluding debt investments. “Other” in the sector allocation chart includes the Arch Company, residential, luxury retail and other assets. “Other” in the geographic allocation chart includes logistics assets in Austria, Belgium, Central and Eastern Europe, Greece, Portugal, Spain and Switzerland. Totals may not sum due to rounding.

- IHS Markit. Actual GDP in USD, as of 2021. Largest European economies represent European countries with GDP greater than $500B.